If you want to invest in Switzerland, you will soon find out that you have a lot of choices when it comes to investing your money in this country. The variety of options is almost as big as the choice of cheese in a Swiss supermarket. With such a choice, you naturally ask yourself: where and how do I invest my money? What is the risk of investing in Switzerland? And what option is the best for me?

And this is exactly what makes investing money quite complicated for beginners – there is always a possibility of losing money as well. However, there is an uncomplicated alternative – Inyova. Create an investment strategy for free, based on topics that are important to you. There’s no obligation to invest if you decide it’s not right for you.

Whether you want to invest your money in Swiss real estate, sustainable stocks, ETFs, funds or you are simply interested in finding out how to best invest money in Switzerland: our detailed guide is designed to give you all the basics you need to help you decide how to invest in Switzerland successfully, in a way that’s right for you.

Let’s take a look!

When is the right time to invest in Switzerland?

Before investing your money, you might ask yourself what time is right to get started. Is now a good time or should you wait until the economic situation has changed?

Unfortunately, there is no right answer to this question. Investors are always hoping for the lowest price when they decide to buy the stock or bond of their choice. Stock market experts are looking closely at every movement of the market and they are making forecasts that you can use as a support to make up your mind – but even their prognosis can be wrong.

For example, in the early 2000s, everyone believed that internet companies like Google or Amazon would not be an insecure investment. Those who didn’t listen to the opinion of the experts and invested in Google stocks in 2004 turned out to be a self-made millionaire 15 years later.

Of course, picking the next winning stock can be like throwing darts with your eyes closed. It is therefore a smart choice to diversify your investments across a variety of companies, industries and regions. Remember: time is the antidote to volatility!

Choose the right time for yourself

Not only should you base your investment decisions on the state of the market, but also evaluate your own personal circumstances.

It is important to understand that your money may be unavailable for a long period of time. If this leads to sleepless nights and makes you worried about how to pay your bills, think again whether it is the right time to make your money work for you for several years.

For example, if you decide to invest in the stock market, you’ll need a minimum amount of CHF 2,000 for a diversified investment. You want to be sure that you won’t need that amount for at least the next five years

If you don’t feel comfortable investing your money for such a long time, it might not be the right time for you.

Another important thing to know is that you are never too young to start investing. Even if you start your investment with a small amount, you’ll see that compound interest builds up over time which has a huge impact on a person’s wealth. No matter your age, it is more important to know what you are hoping to get from your investment in order to find the right investment strategy.

For example, even by the age of 40, you can start investing your money to save up for your retirement. Your investment horizon is still up to 25 years and based on our experience and historical performance, you can expect to make an average return of 6% per year.

The most important thing is that you take your money out of your bank account and get started. Leaving your money in your bank account that offers an interest rate of 0.01% will mean that your savings lose value over time.

The reason for that is that prices increase faster than the return you’ll get from the money in your savings account. Bear that in mind when thinking about investing. We are happy to help you with creating your individual investment strategy. This is a simple way to start investing money.

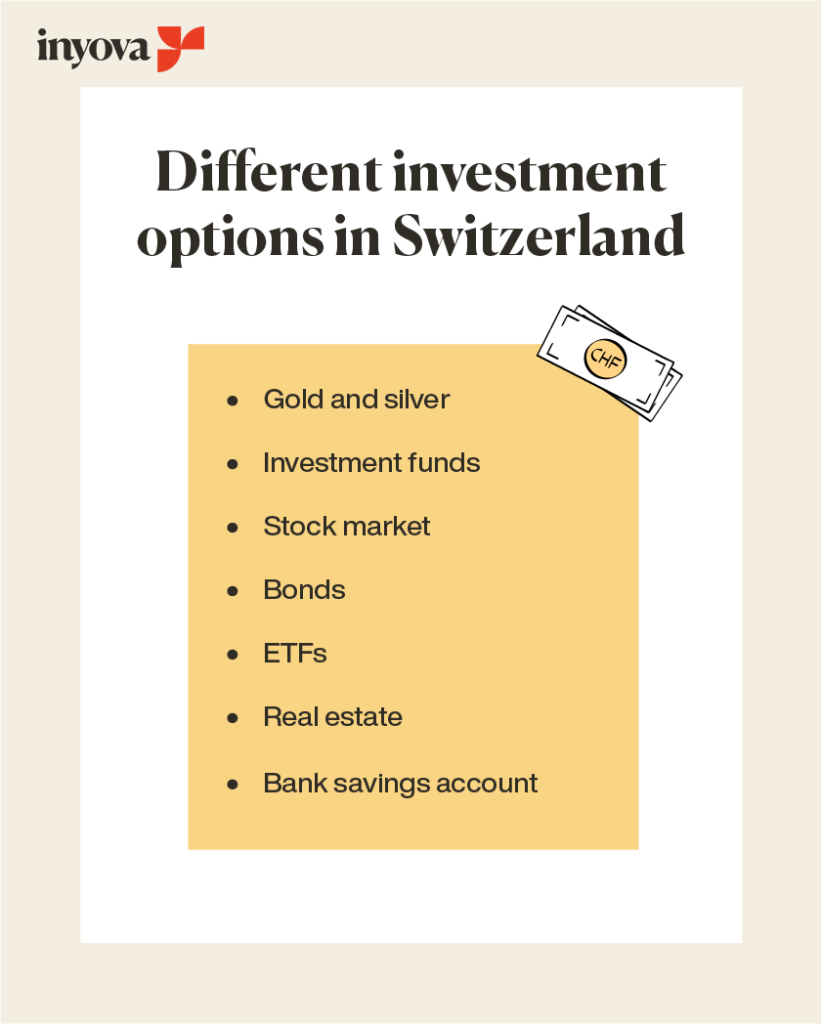

Different Investment Options in Switzerland

Before you start investing, you need to know what you want to invest in. Real estate, gold, silver, stocks, bonds, ETFs? All these options are covered in this article. For a good measure, we’re also going to discuss the pros and cons of keeping your money in your bank account – since this is what many people do by default.

What’s the best way to invest in Switzerland? Jump to the end of this post to find out what we think.

Invest your money in Gold and Silver

People have been investing in precious metals since ancient times, and this remains popular amongst wealthy individuals looking for protection from inflation, deflation, and hyperinflation.

Gold and silver are widely known as a good option for a safe investment in Switzerland and beyond, with a relatively low risk of losing money.

Pros:

- Longevity: Gold and silver have held an underlying value throughout history.

- Safety: Physical bullion is considered safer than the ‘paper market’ of gold and silver.

Cons:

- Cost: Safe storage and insurance costs need to be considered.

- No real return: Precious metals don’t create anything new or better. Their return hinges simply on speculation that the price will increase.

- Impact on people and the planet: Mining gold and silver often takes place under conditions that are harmful.

Invest your Money in Investment Funds

Before investing in investment funds, you need to understand what they are. A fund is a collective investment where your money is pooled together with the money from other investors and actively managed on your behalf.

Fund managers and a high number of other intermediaries are involved in your investment and make buy/sell decisions for you. There are so many types of investment funds that we could create a series of articles just about that. But, here are the most important pros and cons of investment funds.

Pros:

- Diversification: Investment risk is spread across a pool of individual investments, which minimises the risk of losing money.

- Liquidity: You can sell your stocks and generally have the money in your account within seven business days.

- Returns: As Warren Buffett famously illustrated, passively managed funds can outperform actively managed funds.

Cons:

- Hidden fees: Due to their complex and layered structures, funds are notoriously known for hidden fees. Recent investigations uncovered that funds can cost up to four times higher than what you initially thought.

- Questionable sustainability: When investing in funds, you cannot completely control what exactly you are investing in. Instead, you delegate your buy/sell decisions to the fund manager. And even “sustainable” funds are often quite not-so-sustainable at a closer look.

Invest your money in Stocks

Buying stocks gives you an opportunity to participate in a company’s success. A stock turns you into a co-owner of the company you invest in. Thanks to digitalisation, the stock market has become easier and more cost-effective for small investors.

You can also make a positive impact with your investment on topics that are important to you.

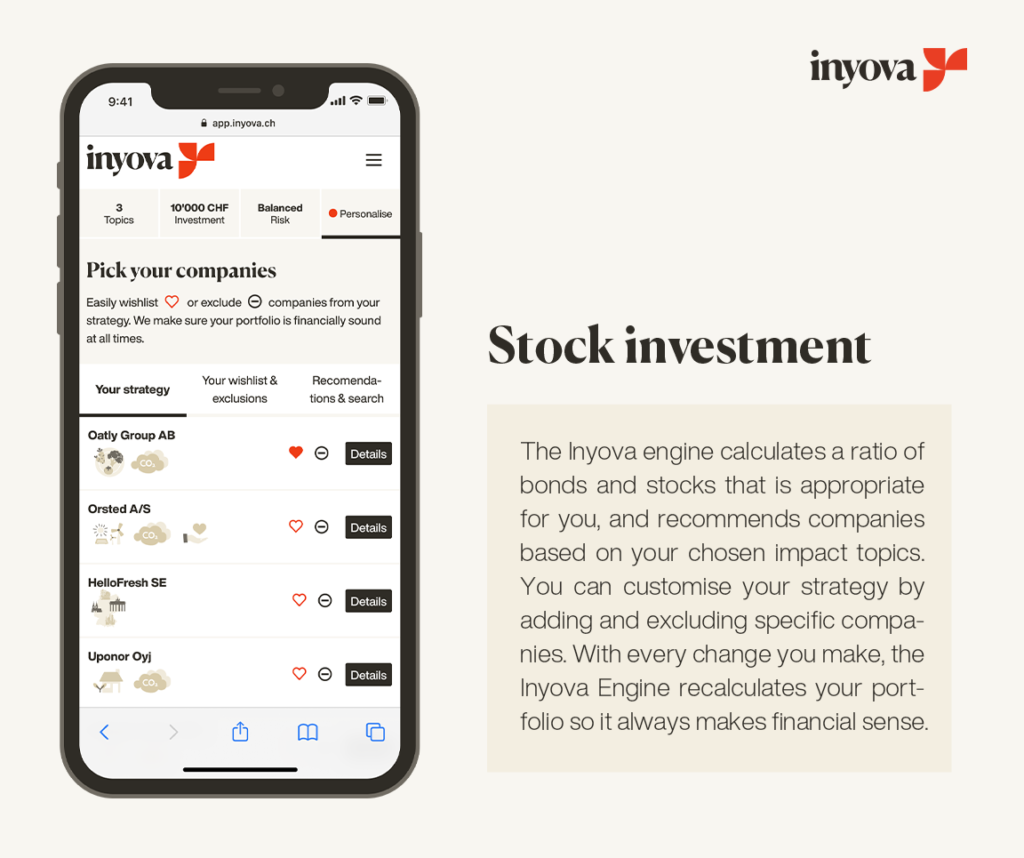

At Inyova, you can create a free investment strategy, in which the companies in the portfolio are compiled based on the impact topics you have chosen. If you don’t like it, there is no obligation to invest.

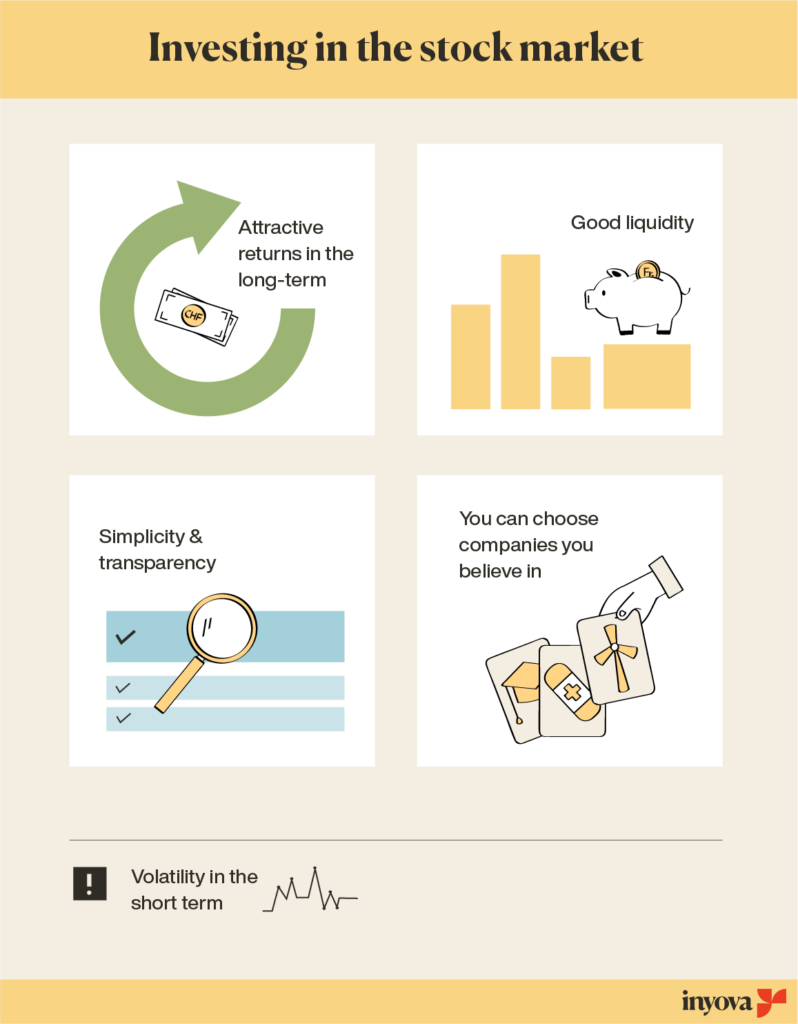

Pros:

- Returns: Historically, the stock market has offered an average return of around 6%. There are also years with negative performance, which is why a long-term investment horizon is important.

- Liquidity: You can sell your stocks and have the money in your account within a few days.

- Simplicity: Unlike derivatives and funds, there are no complex layers between you and your investment. When you buy stock, you own a part of that company.

- Full transparency & control: You invest in each individual company and can, therefore, control exactly which companies you support with your money.

- Sustainability: Due to this control, you can exclude companies or topics that you do not wish to support (e.g. weapons or climate change).

Cons:

- Volatility: Stock value moves up and down on a daily basis. Therefore, it is important to have a big variety of different stocks in your portfolio to minimise the risk of your investment.

- Risk of losses with short-term investments: Due to the fluctuations in prices, stocks can lead to short-term losses. Therefore, a longer investment horizon is a good idea. Historically, an investment period of five to ten years was typically long enough to make profits in the stock market. However, you could still lose money when investing in stocks.

Invest your money in Bonds

Do you want to know how you can invest in Switzerland safely and what interest you can expect? One possibility is to invest in government bonds or corporate bonds.

Briefly explained, bonds are debt obligations. You effectively ‘loan’ a company or government money, and they agree to pay you back (plus interest) within a fixed timeframe. The difference between a loan and a bond is that you can sell and buy bonds on financial markets. If you sell your bond, then the buyer will get all future interest payments as well as the final repayment of the initial sum loaned. Government bonds (bonds) are generally considered an investment with very low risk, but even that doesn’t completely rule out possible losses.

If you decide to invest with Inyova, your portfolio will include green bonds as well as stocks. These are used to finance green projects that generate solutions to the climate problem, such as better access to electricity in Nicaragua.

Create your free Inyova strategy now

Pros:

- Volatility: Typically, bonds are rather steady and have fewer ‘up and down’ movements than other investments.

- Low Risk: It depends on who issued the bond. Investment in Switzerland, in particular in Swiss government bonds, are typically considered low risk, as Switzerland has a strong track record of paying its debts.

Cons:

- Difficulty: Usually bonds have long holding periods and large minimum investments. You can get around the ‘difficulty’ point by buying stocks in a bond ETF, which bundles many bonds together into a fund.

- Returns: Bonds currently have very low returns.

Invest your Money in ETFs (Exchange Traded Funds)

Exchange Traded Funds have recently exploded in popularity and many investors are looking to find the best opportunity for ETF investments in Switzerland. ETFs are usually designed to track an index like the S&P 500.

Pros:

- Diversification: Many ETFs are built to have a comparatively high level of diversification.

- Ownership: You own a stock in a financial structure, not the company’s stocks themselves.

- Cost: As they are passively managed, ETFs are much cheaper than traditional funds.

Cons:

- Complexity: Sometimes fund managers buy ‘warrants’ and ‘equity swaps’ instead of the stocks. This is called a ‘synthetic replication’ and can turn an ETF into a highly complex structure with risks that are difficult to assess.

- Sustainability: Unfortunately, this is the same story as mentioned earlier with funds. When investing in ETFs, you cannot include or exclude specific companies in your portfolio. Be aware that sustainable ETFs are often a lot less sustainable than they claim.

Invest your Money in Real Estate

With rent prices on the rise, it is not surprising that a lot of people in Switzerland are thinking about investing in their own property. There’s nothing wrong with giving up a rental property in order to invest your money in a home. But there are some important considerations to make.

To give you a heads-up: in general, it is better to buy a house for yourself than treat it as an investment. As it has become very expensive during the last few years to buy your own property, the return from real estate investment in Switzerland is quite low.

Pros:

- Low volatility: House prices are generally stable in Switzerland, although they have risen over the last two years.

- Illiquidity: If you want to sell your investment, you will need to find a buyer. This can take months or years, in extreme cases.

- Costs of living: If you live in your real estate you can save a lot of money on rent. In that way, you won’t get a high return – but at least you know that you will always have a house that is owned by you.

Cons:

- High costs: Property is expensive in Switzerland (average is CHF 6,916 per square metre) and a large deposit is required. Don’t forget the agent’s commission, marketing costs and real estate transfer tax, too.

- Taxes: Depending on your form of financing, real estate investment in Switzerland can be a tax hassle due to the taxation of the imputed rental value (“Eigenmietwert” in Switzerland).

- High risk due to leverage: If you finance a real estate investment with 20% of your own money and the real estate value goes down by 20%, your money is gone. But, you still need to repay the bank at a higher price. This can happen, as numerous real estate crises have shown in the past.

- Lack of diversification: Buying a house will require a majority of your money. Therefore, you won’t get the chance to buy other investments that could help you survive a real estate crisis.

- Hassle-factor: If you are planning on renting the real estate out, you will have to take care of property maintenance and managing tenants. Don’t underestimate the amount of time and money it takes to look after a house.

- Low returns: Swiss real estate became so expensive in the early 2020s that the relation between purchasing price and imputed rental value is often below 5%. Considering the risk involved, that’s not all too high.

Invest your Money in Cryptocurrencies

Are cryptocurrencies such as Bitcoins, Ether, XPR or the new Facebook currency Libra a hype that we should ignore, or is it the investment of the future? At the moment, it is really hard to judge, as some people became millionaires investing in cryptocurrency, and many others have lost their life savings. Overall, it’s an interesting space to watch, but this is a new frontier – a bit like the Wild West in the 1800s!

For some cryptocurrencies, such as Bitcoin, massive amounts of energy are also used. In Montana, USA, an old coal-fired power plant was revived by a Bitcoin mining company, which caused CO2 emissions to skyrocket.

Pros:

- Easy: Transactions are easy and fast, especially because there are few regulatory constraints around them.

- Cool technology: Decentralised networks are an interesting alternative to traditional banking models, as it increases security.

- Instability: While social, economic and political instability can harm the stock market, the opposite seems to be true for cryptocurrency.

Cons:

- High volatility: The cryptocurrency market is a bit like a rollercoaster!

- No real return: Like precious metals, cryptocurrencies don’t have a real return, but are only a bet on price increases.

Invest your Money in your Bank Savings Account

Strictly speaking, putting money into your bank savings account is not investing! But we wanted to mention this option since many people default to keeping their life savings in their bank account.

Pros:

- Guarantees: If your bank goes bankrupt, you’re covered for up to CHF 100,000.

- Access: If you need your money in the next year or two, keeping it in the bank account is a great idea.

Cons:

- Negative returns: Typically, a Swiss bank pays 0.01% interest. Prices in the real world grow a lot quicker, which means that you end up losing wealth.

- Hidden costs: Banks are masters in disguising fees. So make sure you know what you’re paying for in your bank’s savings account.

What is the best way to invest your money in Switzerland?

Many successful investors believe that long-term stock investments are the best form of investment for most people. However, every situation is different, so you should seek advice tailored to your personal circumstances.

As an important point, these experts mention that you invest in a diversified portfolio of 30-40 company stocks, spread across different countries and industries. This way you avoid your entire portfolio only being linked to the success of a few companies

Depending on your age, the length of time you want to invest for, and other factors, it may be useful to put a portion of your investment into government bonds. But what about the strongest argument against stocks – what if the companies you invest in crash and burn down? That’s a great point! A drastic fall in prices only means a loss if you implement it on paper. However, the past shows that in many cases there is a simple method to overcome price fluctuations.

Long-term Investments and Diversification

In March 2020, the Dow Jones experienced its biggest one-day drop in history. It was a nerve-wracking period and some investors sold their stocks resulting in large losses. Within a few weeks, the market returned to where it started and those who hadn’t sold breathed a sigh of relief – they were now making positive returns again.

Experts advised investors to hold steady and not sell their stocks in a panic. These market fluctuations are to be expected – we account for these happening. Sure enough, the market had returned to previous levels within a couple of weeks.

So not all crashes spell disaster. Especially not for investors who are in it for the long run. This is why experts advise you to invest your money for a period of at least five years. Market fluctuations, highs and lows are all perfectly normal. They only affect you if you are looking for a quick buck.

These situations also show us why diversification is so important – although some crises are felt across the worldwide economy, it’s more often concentrated on a particular industry or region. Imagine if 100% of your investment was in the technology companies right before the Dot Com Bubble burst at the beginning of the millenium, or 100% in the Brazilian stocks before it entered its recent recession. What followed was a crash and you would have lost most of your money in a short time.

Spreading your investment means you won’t be wiped out by these downturns. At Inyova, spreading your investment across 30-40 companies in different industries, regions, currencies, and other factors means that your investment will be spread across 30-40 companies. This brings us to a common question our investors ask us:

Should I Invest in Swiss Stocks or Foreign Stocks?

Many people around the world consider Switzerland to be one of the safest places to invest. The Swiss stock market is generally powered by the country’s strong economy, low inflation, low national debt and a consistently low unemployment rate.

Before you commit and invest in Switzerland and its companies, remember that this “safe haven” status brings a few downsides, as well. During a crisis, foreign and local investors alike jump at the chance to invest in Switzerland.

This means that the Swiss Franc and stock markets can quickly become overvalued. And this is not just a doomsday scenario powered by imagination. A situation like this happened back in 2012, when the Swiss Central Bank took the most dramatic action in its history: they tied the Franc’s value to that of the Euro to make sure its rise was curbed.

To answer the question that brought us here: Yes, you should invest in Swiss companies, but also in foreign ones. Therefore, many investors hold a portion of their investment in Swiss stocks, but also buy stocks from around Europe and America to achieve diversity. This prevents the investment from being unnecessarily exposed to risks in one single country.

That brings us to another common question:

How much Money Do I Need to invest?

When it comes to investing in the stock market, there is no one-size-fits-all. You can start small or go as big as you can.

Most people assume you need to be rich to start investing. That’s completely wrong! To start investing in Switzerland, CHF 2,000 is suitable as a minimum investment. This is generally the amount you need to buy a variety of different stocks and achieve a good diversification.

When you invest small amounts of money, one common mistake is to put them all in one place. After all, why divide a small amount? Actually, it’s better to invest in 30-40 local and foreign companies. This gives you good diversification, which means you can expect your investment to grow at around the same rate as the market (historically, this has been 6% per year).

How to Start Investing

Don’t worry, we’ve gone to great lengths to make it easy for you to start investing. Get your free investment strategy and customise it by picking your investment themes and personal risk profile. As soon as you are satisfied with your individual portfolio, you can start opening your account. That’s it!

After you transfer your investment sum into your trading account, we take care of all the technical details on your behalf. This includes monitoring your investment, annual rebalancing, and the fulfilment of shareholder obligations (if you don’t want to do these yourself).

Key points to remember about investing in Switzerland

To sum it up, we want to remind you of the most important points of this article. This will help you to keep an overview of all the investment opportunities in Switzerland.

- Information is important: Different ways to invest have different pros and cons. Always consider the risk and expected return but also take note on whether you can access your money when you need it.

- Stocks offer historically good returns: Stocks are one of the best forms of investing because, historically, they have offered comparatively good returns over a long period of time with controllable risk. You can start with small amounts and quickly access your investments when you need them. But you should always keep the risk in mind, because you can also lose your money.

- Sustainable investing made easy: Directly investing in stocks makes sustainable investing simple. Unlike other forms of investment such as funds or ETFs, with stocks you can determine exactly which companies you invest in and which you don’t invest in. At Inyova, we’ve developed a way to ensure that money only flows into companies that match your values – without compromising returns.

- Diversification brings stability: Depending on your financial goals and risk profile, you can split your money between stocks and bonds. Bonds offer more stability in the long run, but less income. A portfolio at Inyova consists of 30-40 companies from different regions, industries, different currencies and other factors.

Using our online tool, you can easily pick the sustainable and socially responsible investment themes that are most important to you. You can also adjust your financial goals and risk preferences. With every adjustment you make, our algorithm makes sure your portfolio is financially sound. This way, you can control where your money goes – without compromising your returns.

Once you’re happy with how your portfolio looks, you can start investing and we will guide you through opening an account. We will then take care of all the technical details for you.

This makes investing for beginners a pleasant experience, where they know they are in good hands and don’t have to invest much time. The Inyova app gives you an overview of how your investment is developing at all times.

Do you have any questions? Drop us a message. We are always happy to help you!